Your Value Proposition Sounds Like Everyone Else's (And Your 2025 Results Prove It)—How to Differentiate in 2026

Your Value Proposition Sounds Like Everyone Else's (And Your 2025 Results Prove It)—How to Differentiate in 2026

Strategic Analysis by: Insight2Strategy

Published: January 19, 2026

Executive Reading Time: 10 minutes

Executive Strategic Insights

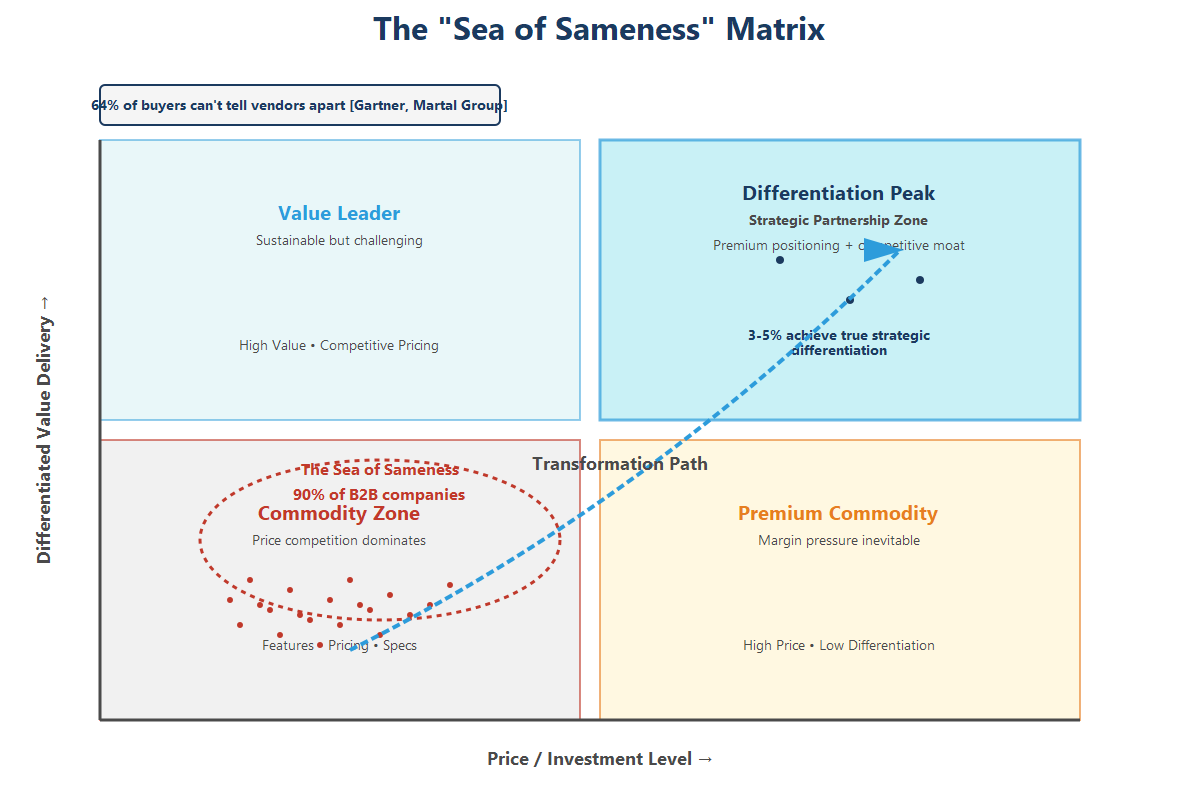

- 64% of B2B buyers cannot differentiate between vendor digital experiences—your value proposition has become invisible in the noise

- Companies with clear differentiation achieve 23% higher revenue growth and 19% higher profit margins than industry peers

- Generic positioning creates a 34% longer sales cycle and 27% higher customer acquisition costs

- The Value Triad Framework identifies the intersection of customer pain, competitor blind spots, and your unique capabilities

- 2026 requires consultation positioning—strategic partners command 2.3x higher lifetime value versus transactional vendors

- Five-step implementation framework moves from competitive audit to enterprise-wide operational alignment

The Invisible Value Proposition Crisis

As a business leader reviewing your 2025 performance, you're likely seeing a troubling pattern: despite solid products, marketing investments, and full pipelines, growth has plateaued. Sales cycles lengthened. Win rates declined. Discount pressure intensified. And when prospects chose competitors, they struggled to articulate why.

Here's the uncomfortable truth backed by data: 64% of B2B buyers cannot tell one brand's digital experience from another (Martal Group, 2025). Meanwhile, 77% of B2B buyers complete their research before ever speaking with sales (Gartner, 2024). Your value proposition has become invisible in the digital noise—and when every competitor claims to be "innovative," "customer-centric," and "results-driven," buyers default to the only differentiator they can measure: price.

The stakes are particularly high heading into 2026. Economic uncertainty demands that every marketing dollar deliver measurable ROI. AI-driven efficiency means buyers can evaluate more vendors faster—amplifying the penalty for generic positioning. And with 61% of B2B buyers preferring a rep-free experience (Forrester, 2025), you're being disqualified without ever knowing why.

⚡ Quick Implementation Tip

Pull your last 10 lost deals and ask one question: "Could the prospect have said the same thing about our competitors?" If the answer is yes for more than half, your differentiation problem is costing you real revenue.

This isn't about tweaking taglines or refreshing your website. This is about strategic repositioning that transforms your value proposition from a commodity descriptor into a competitive moat—the kind that commands premium pricing, shortens sales cycles, and positions you as the only logical choice for your ideal customer.

Why Generic Value Propositions Are Strategic Liabilities

From a C-suite perspective, a weak value proposition isn't just a marketing problem—it's an enterprise-wide strategic liability that compounds across every function.

Consider the operational cascade: When marketing can't articulate differentiated value, they cast wider nets with generic messaging. Sales compensates by discounting to close deals. Product builds features that match competitors rather than serving unique customer needs. Customer success struggles to demonstrate ROI because the value promise was vague from the start. Finance sees margin erosion while the CEO watches market share slip to competitors who aren't necessarily better—just clearer about what makes them different.

The data validates this painful reality: 71% of B2B marketers say they're communicating a distinct positioning—yet 68% of buyers say most brands "all sound the same." That perception gap is killing your growth (swordandthescript.com, 2024).

Research from McKinsey shows that B2B companies with clearly differentiated value propositions achieve 23% higher revenue growth and 19% higher profit margins than industry peers. Yet their 2024 survey found that only 31% of B2B organizations can articulate a value proposition that resonates distinctly with their target segments.

When Bain studied B2B purchase decisions, they found that companies with undifferentiated value propositions faced 34% longer sales cycles and 27% higher customer acquisition costs. Your 2025 results likely reflect some version of this pattern.

📊 Strategic Context for CEOs

According to Forrester's 2025 research, over 80% of B2B buyers expressed dissatisfaction with the provider they selected, often citing lack of differentiation or poor vendor experience rather than price alone. In today's risk-averse buying environment, when faced with choices that look the same, buyers default to the familiar—vendor trust or brand awareness becomes a form of "anxiety insurance."

The Executive Framework: Three Strategic Pillars for Building Differentiation

Effective value proposition differentiation doesn't start with messaging—it starts with strategic choices about who you serve and how you compete. This requires executive-level decision-making about market positioning that many leadership teams avoid because it means saying "no" to revenue opportunities that don't fit.

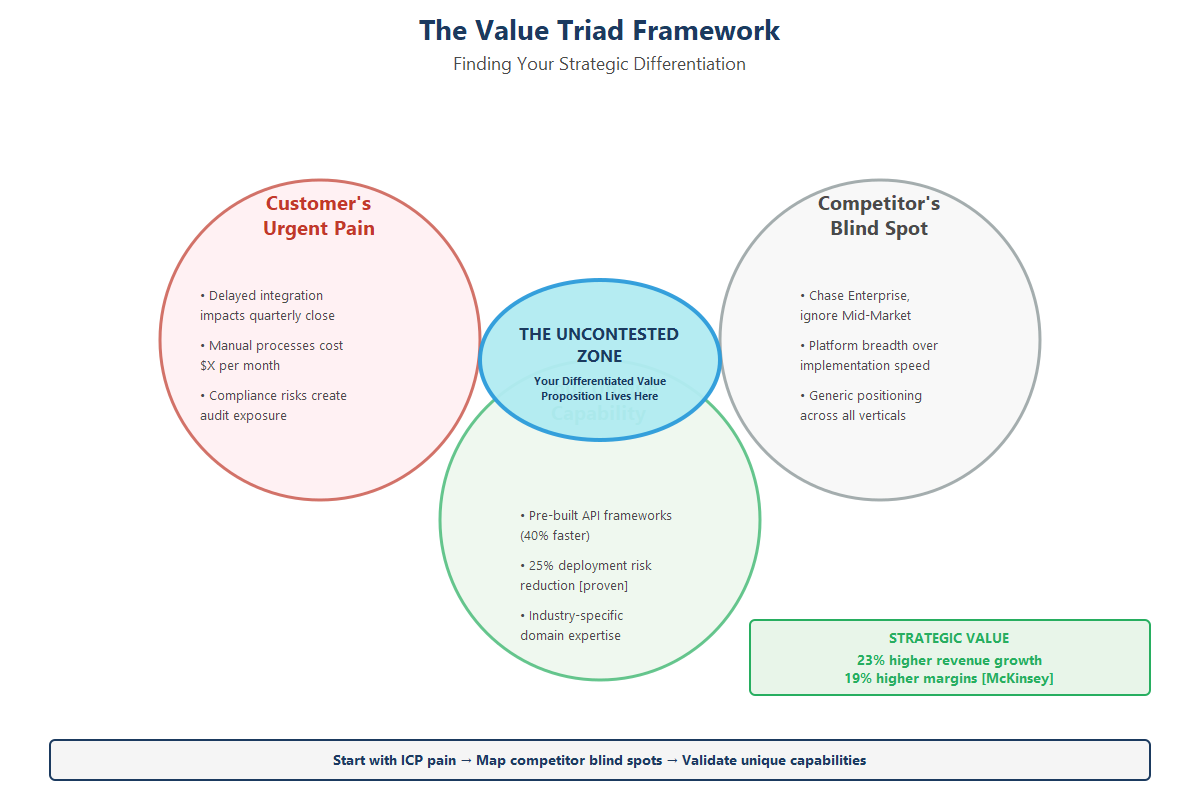

Pillar 1: Strategic Market Selection (The Value Triad)

Traditional ICP work identifies demographics. Strategic market selection identifies the specific market context where your capabilities create disproportionate value. The framework has three components:

1. The Customer's Urgent Pain

You cannot differentiate for everyone. You must differentiate for a specific buyer facing a specific, expensive problem. This ties directly back to the ICP work from earlier in this sequence—without knowing WHO, you cannot articulate compelling WHY US.

2. The Competitor's Blind Spot

This is where most strategies fail. You must identify what your competitors are ignoring. Are they all chasing Enterprise clients, leaving the Mid-Market underserved? Are they all focused on "platform breadth" while the customer is desperate for "implementation speed"? Your strength is irrelevant if your competitor claims it too.

3. Your Unique Capability (With Proof)

What can you objectively prove? If you claim speed, do you have the data? If you claim ROI, do you have the case studies? Your capability acts as the "Reason to Believe" that anchors the claim.

💡 Real-World Application

A mid-market software company competed unsuccessfully in "marketing automation" until they focused exclusively on B2B companies with complex, multi-stakeholder buying processes. Their platform wasn't better at email—but their workflow engine and approval hierarchies were uniquely suited to organizations where 8-12 people influence decisions. That strategic market selection transformed their value proposition from "better automation" to "the only platform built for consensus-driven B2B buying."

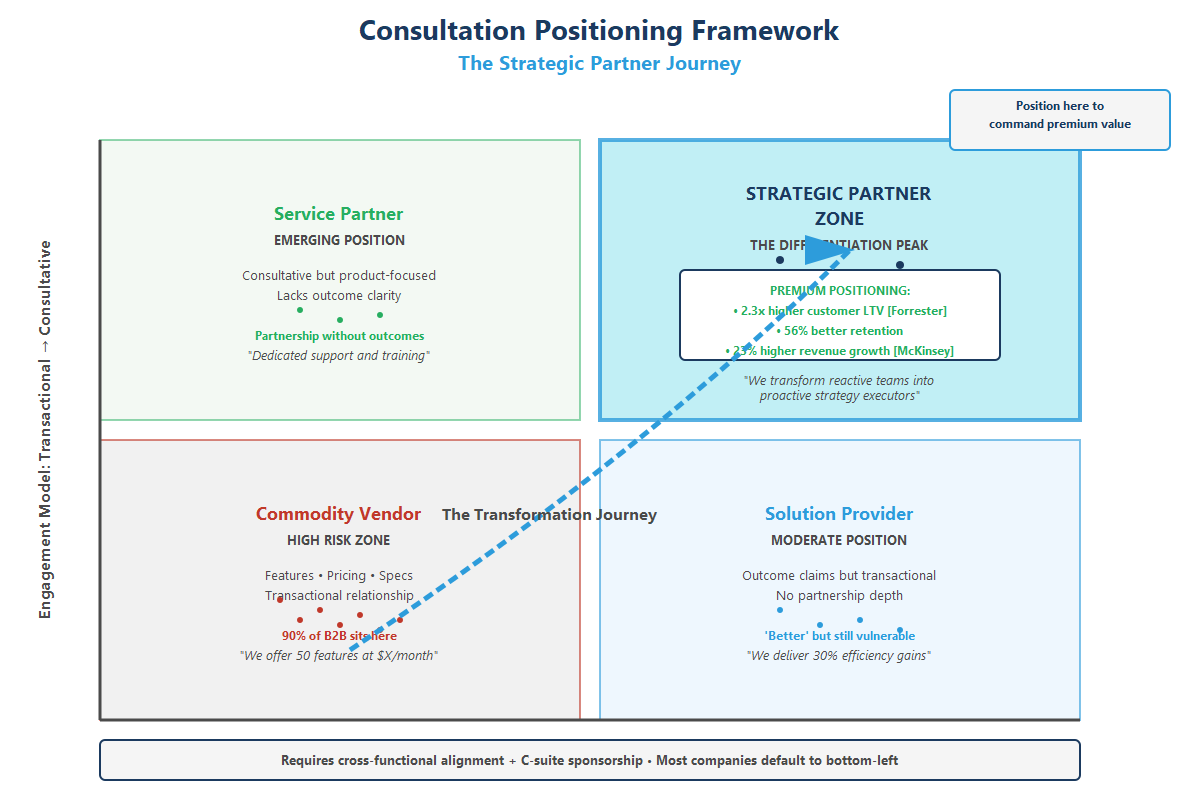

Pillar 2: Consultation Positioning (Not Just Competitive Positioning)

C-suite leaders understand that premium B2B vendors aren't just providers—they're strategic advisors. Your value proposition should position you as a consultative partner who understands not just what prospects need to buy, but why they need to transform.

This shifts from "we have features X, Y, Z" to "we've seen companies at your stage face three critical challenges when attempting to [outcome], and here's how we guide them through it." That consultation positioning immediately differentiates you from vendors who sell products versus partners who enable transformation.

Research from Forrester shows that B2B vendors positioned as strategic advisors (not just providers) achieve 2.3x higher customer lifetime value and 56% better retention.

Pillar 3: Transformation Framing (Not Just Value Delivery)

Executive buyers don't buy solutions—they buy transformation. Your value proposition should articulate the strategic state change you enable: "from X to Y" rather than "we deliver Z."

A professional services firm shifted from "we provide strategic planning consulting" to "we transform reactive leadership teams into proactive strategy executors who hit their three-year targets in 18 months." Same service. Completely different value proposition. Their close rate increased 43% within two quarters because they spoke to the transformation C-suite leaders actually wanted to buy.

The Practical 5-Step Implementation Framework

From strategic intent to operational reality, here's the cross-functional implementation framework:

Step 1: Audit Your Competitive Landscape with Operational Rigor

Before crafting your unique value proposition, map your competitive set—not just direct rivals, but substitutes like in-house builds or ecosystem partners. Use a cross-functional audit involving sales, product, and customer success to score competitors on 40 elements of B2B value, from table stakes (like cybersecurity) to inspirational drivers (like vision alignment).

Dive into operational metrics: How does your integration speed stack up? What's your uptime SLA versus theirs? In one client engagement, we uncovered that while competitors touted "AI-powered analytics," our client's edge was in cross-functional data governance—reducing implementation time by 40% through pre-built API frameworks.

⚡ Implementation Tip

Form a UVP task force with quarterly reviews. Assign owners for data collection (NPS surveys, win/loss analysis) to ensure your audit evolves with market shifts.

Step 2: Align Internally Through Change Management Frameworks

Here's where most value propositions fail: They sound great on paper but crumble in execution due to siloed teams. Effective differentiation requires cross-functional coordination—marketing owning the narrative, sales delivering it conversationally, and ops proving it in deployments.

Leverage change management frameworks like Kotter's 8-Step Model: Create urgency with 2025 results data, build a guiding coalition of C-suite sponsors, and pilot your UVP in one ICP segment.

Governance focus: Establish UVP scorecards that tie messaging to KPIs, like conversion uplift from A/B tested landing pages. For advanced audiences, integrate OKRs that link UVP adherence to bonuses—turning abstract strategy into operational accountability.

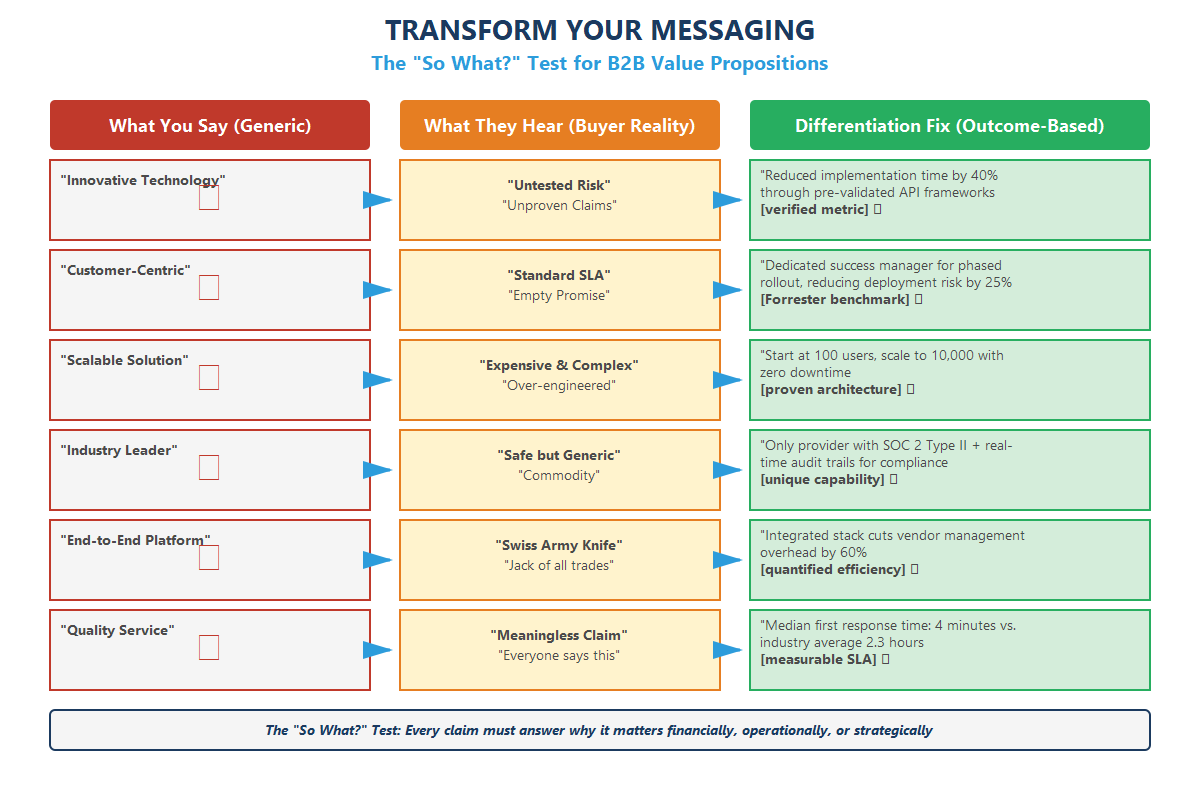

Step 3: Translate Strengths into Buyer-Relevant Outcomes (The "So What?" Test)

Generic claims like "innovative" or "customer-centric" trigger skepticism, not trust. Apply the "So What?" test to every claim:

- Draft: "We offer AI-driven analytics."

Test: So what? Everyone does. - Draft: "We provide real-time insights."

Test: So what? What does that change for me? - Differentiation: "We predict supply chain failures 48 hours before they happen, saving the average client $2M per quarter."

The difference is specific, economic, and verifiable. Convert what you do into what clients care about: revenue lift, cost saving, risk reduction, time saved, speed to value.

Step 4: Validate with ICP-Specific Proof Points

Conduct customer interviews framed around operational pain: "How does delayed integration impact your quarterly close?" Use these to quantify value—e.g., "Our framework reduces deployment risks by 25%, per Forrester benchmarks on self-serve adoption."

💡 Pro Tip

Build a value calculator tool, governed by sales ops, to dynamically demonstrate ROI. This shifts conversations from features to outcomes, boosting close rates by addressing buyer skepticism head-on.

Without proof (case studies, metrics, testimonials), claims feel empty—especially in risk-averse buyer groups. According to UserEvidence research, many buyers distrust vendor messaging unless backed by credible proof.

Step 5: Embed Differentiation Across All Touchpoints (Enterprise Alignment)

True differentiation requires operational follow-through:

- Marketing: Rebuild content architecture around the strategic value narrative, optimize for SEO keywords like "unique value proposition B2B"

- Sales: Retrain on consultative conversations anchored to strategic transformation, update decks and proposals

- Product: Roadmap features that reinforce your differentiated positioning

- Customer Success: Redefine success metrics around transformation outcomes

This phase determines whether your new value proposition becomes strategic reality or remains marketing rhetoric. Expect resistance. Expect confusion. Expect the gravitational pull back to generic positioning. Executive sponsorship and accountability are non-negotiable.

Use pulse surveys to gauge adoption and iterate. In high-complexity scenarios, invest in enablement platforms for real-time UVP tracking, ensuring every touchpoint reinforces your edge.

Why This Matters Now: The 2026 Strategic Context

The business environment heading into 2026 rewards strategic clarity and punishes positioning ambiguity. Three forces are accelerating the need for differentiation:

Economic Reality: With capital costs elevated and growth investments under scrutiny, buyers demand ROI clarity. Generic value propositions can't deliver the business case precision that finance leaders require for approval.

AI-Driven Evaluation: Buyers now use AI tools to compare vendors across dozens of criteria. If your value proposition doesn't contain distinct, searchable differentiation, you'll be algorithmically filtered out before a human ever reviews your offering. More than half of large B2B transactions are now processed through digital self-serve channels.

Consultative Premium: The market is bifurcating between commodity vendors competing on price and consultative partners commanding premium positioning. As we move further into 2026, the "Sea of Sameness" will only get more crowded with AI-generated noise.

🎯 Strategic Imperative

The companies that thrive in 2026 won't be those with the best products—they'll be those with the clearest strategic positioning about who they serve, what transformation they enable, and why they're the uniquely qualified partner to deliver it.

Strategic Questions Executives Ask About Value Proposition Differentiation

How long does strategic repositioning typically take?

For most mid-market B2B companies, expect 3-6 months from competitive audit to full operational alignment. The strategic work (Steps 1-3) takes 4-8 weeks. Internal alignment and change management (Steps 4-5) takes another 8-12 weeks. Companies that skip the alignment phase see their new value proposition fail within 90 days.

What budget should we allocate for value proposition development?

Strategic consulting for the competitive audit and positioning work typically runs $25K-$75K depending on market complexity. Internal implementation costs (training, content development, sales enablement) add another $50K-$150K. However, companies that achieve true differentiation see 23% higher revenue growth—making this one of the highest-ROI strategic investments you can make.

When should we hire outside expertise versus handling this internally?

Internal teams bring market knowledge but often lack objectivity and cross-functional authority. External consultants provide competitive intelligence, executive facilitation, and accountability frameworks. The ideal approach combines internal ownership with external strategic guidance—particularly for the competitive audit and change management phases where neutrality matters most.

How do we measure ROI on strategic value proposition work?

Track four key metrics: (1) Sales cycle length—should decrease 15-25% within two quarters, (2) Win rate against identified competitors—should improve 20-30%, (3) Average deal size—premium positioning enables 10-20% price improvement, (4) Marketing-qualified lead conversion—should increase 25-40% as messaging resonates with ideal buyers. Companies with clear differentiation see measurable improvement across all four metrics within 6-9 months.

From Generic Promise to Strategic Differentiation

Your value proposition isn't a marketing asset—it's a strategic declaration of how you compete, who you serve, and what transformation you enable. When 64% of B2B buyers say they can't distinguish between vendor options, differentiation isn't about being incrementally better—it's about being strategically distinct.

The question isn't whether your product or service has merit. The question is whether your value proposition articulates that merit in ways that resonate with the strategic priorities of the executives evaluating you.

If your 2025 results showed the warning signs—lengthening sales cycles, eroding margins, commoditization pressure, flat growth despite marketing spend—2026 is the year to address the root cause. Not with messaging tweaks, but with strategic repositioning that transforms how your market perceives and values what you deliver.

Ready to Move from Generic Positioning to Strategic Differentiation?

Our Value Proposition Differentiation Session works with your leadership team to audit your current positioning, identify strategic differentiation opportunities using the Value Triad framework, and build the cross-functional implementation plan with change management support.

This isn't a marketing workshop—it's a strategic planning session that aligns your team on who you serve, what transformation you enable, and how you position for premium value capture.

No sales pitch. Just strategic insights that align with your 2026 growth objectives.

About Insight2Strategy

We help growing businesses cut through marketing confusion to find strategies that actually drive revenue and customer growth. Our consultation-focused approach combines strategic frameworks with operational implementation guidance.

Comments

Post a Comment